Bankruptcy.

Lowest Fees Guaranteed.

File Today, Pay Fees Over Time.

$99 Starts Your Case.

Questions about whether bankruptcy is right for you? We have answers– and the initial consultation is always free. Don’t continue struggling. Call now. Payment plans offered.

- Bankruptcy Immediately Stops:

-Wage Garnishments, bank levies, Lawsuits, Repossessions, foreclosures, harassment from bill collectors and more.

Bankruptcy.

Lowest Fees Guaranteed.

File Today, Pay Fees Over Time.

$99 Starts Your Case.

Questions about whether bankruptcy is right for you? We have answers– and the initial consultation is always free. Don’t continue struggling. Call now. Payment plans offered.

- Bankruptcy Immediately Stops:

-Wage Garnishments, Bank Levies, Lawsuits, Repossessions, Foreclosures, Harassment From Bill Collectors and More.

Professional and Experienced Bankruptcy Attorney.

Why Over 2,000 Southern Californians Have Chosen the Debt Solution Law Group:

Experienced.

At Debt Solution Law Group we have the expertise to successfully handle almost any bankruptcy matter, just as we have for over 2,000 San Diegans since 2005. Our lead Attorney Steven E. Cowen attended the University of San Diego School of Law, graduating at the top of his class, cum laude, in 1987. He was also a member of the law review. Mr. Cowen is a member of the State Bar of California and a member of the National Association of Consumer Bankruptcy Attorneys. He is fluent in English and Spanish.

Lowest Fees Guaranteed.

Fixed fees. Bring in any competitor’s written price for needed work, and we’ll beat it. No gimmicks. No bait and switch or sham “promotions”. We don’t like being treated that way, and we know you don’t either.

Easy Payment Plan.

Typical payment plan: total fees divided into five payments. If you need a more customized plan, tell us! Make the first payment, and we will file your case. You won’t hear us say, “we take payments, but you have to pay us in full before we will even begin working on your case.” Same day filing if need be and at no extra charge. We stop creditor harassment, lawsuits, wage garnishments and bank levies dead in their tracks.

Convenient.

Do you want to know if you qualify for bankruptcy and what bankruptcy can do for you? At the free initial consultation with an attorney, we will take the time to understand every facet of your case, and let you know if bankruptcy is the answer to your personal financial situation. Our first appointment is at 9:00 a.m., and the last at 8:00 p.m. Our offices are conveniently located in Downtown San Diego, El Cajon, Chula Vista, Serra Mesa and Escondido with plenty of free parking and easy freeway access. If you do decide to go forward, we make the process convenient. We ask questions, you provide answers, and that is how we get the paperwork ready for filing with the court.

A Payment Plan that's built to get your case filed quickly.

We divide our fees and file your case before we have been paid in full. You will be able to make fee payments while your case is already on-going.

Personal service you can count on.

Our lead attorney handles all of our consultations. You will have the peace of mind knowing that you are speaking with, and your questions are being answered by, the best in the business.

Our office locations:

About Our Lead Attorney:

Attorney Steven E. Cowen attended the University of San Diego School of Law, graduating at the top of his class, cum laude, in 1987. He was also a member of the law review. Mr. Cowen is a member of the State Bar of California and a member of the National Association of Consumer Bankruptcy Attorneys. He is fluent in English and Spanish. Mr. Cowen is an an accomplished outdoors-man and has been featured in news papers and magazines due to his knowledge of the San Diego County back country. Steve has successfully handled over 2,000 bankruptcy cases in Southern California.

Call us now!

619-202-7511

We Take Customer Service Seriously.

What Our Clients Say About Our Services:

----- Positive Credit Impact.

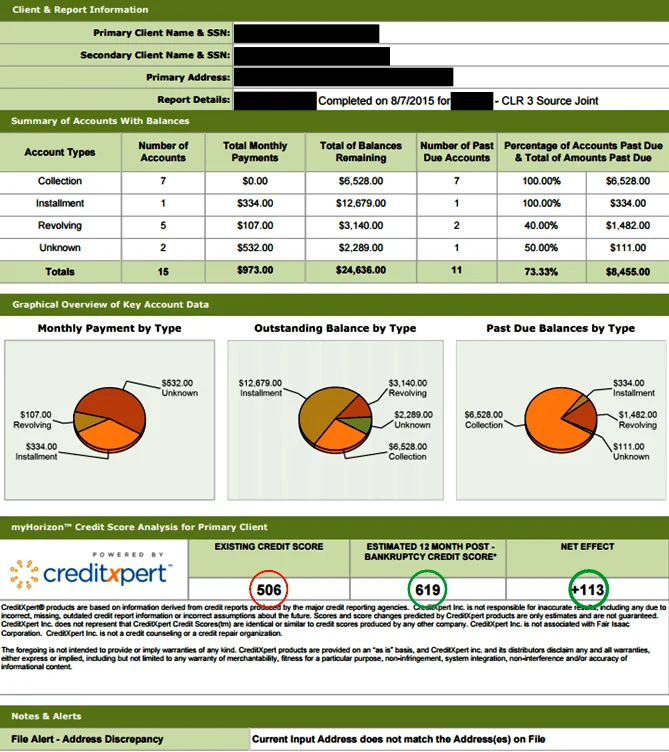

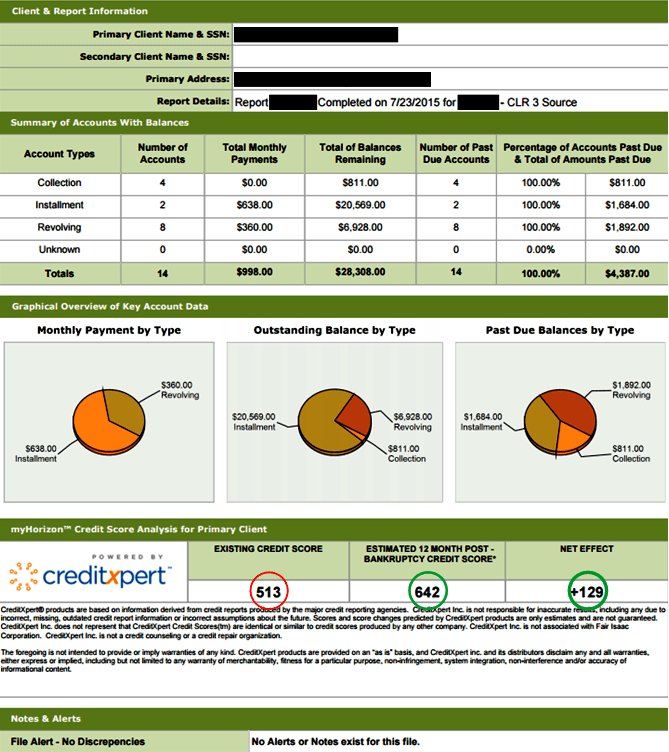

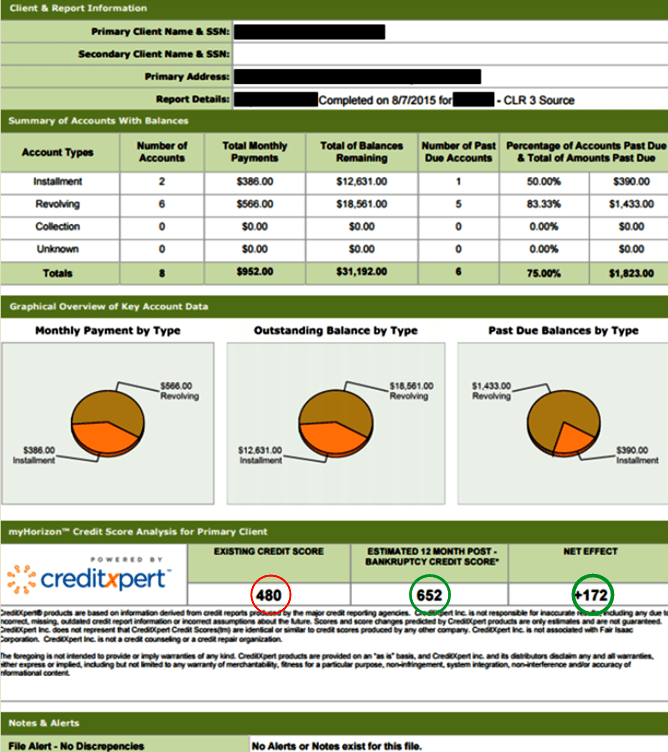

Positive Credit Impact post filing:

In nine out of ten cases, our clients see their credit score increase anywhere from 25 to 180 points the first year after filing bankruptcy. Things really have changed. While in the bankruptcy process, our clients receive multiple letters from car dealers saying “hey, we know you’re in bankruptcy, but come talk to us and let’s see if we can work out a better deal for you on a car.” The sooner you file, the sooner your credit score will rebound which means lower interest rates on car loans. Filing sooner rather than later will also get you in line faster to qualify for a home loan.

Get Your Free Credit Report Today: Clients of The Debt Solution Law Group receive a free credit report at their first meeting. If you want to know to what extent bankruptcy will increase your credit score, but have not yet decided on whether you want to file bankruptcy, we can obtain a credit report for you for a nominal charge.

Professional And Experienced Bankruptcy Attorney.